The overall cost of the inventory item is not readily available and the quantity (except by visual inspection) is unknown. At any point in time, company officials do have access to the amounts spent for each of the individual costs (such as transportation and assembly) for monitoring purposes. But a company using a periodic inventory system will not know the amount for its accounting records until the physical count is completed. An additional entry that is related to the periodic inventory system, but which does not directly impact inventory, is the sale transaction. The following entry shows the transaction that you record under a periodic inventory system when you sell goods.

Comprehensive Guide to Inventory Accounting

The guide has everything you need to understand and use a periodic inventory system. You’ll find basic journal entries, formulas, sample problems, guidance, expert advice and helpful visuals. Because these costs result from the acquisition of an asset that eventually becomes an expense when sold, they follow the same debit and credit rules as those accounts. The alternative way of updating inventory, and therefore cost of goods sold, is called the periodic method.

Would you prefer to work with a financial professional remotely or in-person?

In the periodic system, you only perform the COGS during the accounting period. The term periodic inventory system refers to a method of inventory valuation for financial reporting purposes in which a physical count of the inventory is performed at specific intervals. As an accounting method, periodic inventory takes inventory at the beginning of a period, adds new inventory purchases during the period, and deducts ending inventory to derive the cost of goods sold (COGS). It is both easier to implement and cost-effective by companies that use it, which are usually small businesses. When paying for inventory purchased on credit, we will decrease what we owe to the seller (accounts payable) and cash. If we take a discount for paying early, we record this discount in the purchase discount account under the periodic inventory method.

- Accountants do not consider it as an airtight method to determine the annual inventory balance, as it is not precise enough for financial statement reporting.

- The transaction will reduce the purchase which is the inventory account and it will decrease the accounts payable as the supplier has agreed.

- This means that a company using this system tracks the inventory on hand at the beginning and end of that specific accounting period.

- The inventory isn’t tracked on a regular basis or when sales are executed.

- Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

- That’s why businesses with high sales volume and multiple sales channels use a perpetual inventory system, instead.

Determining Cost of Goods Sold and Ending Inventory

Determining the cost of the ending inventory and the cost of goods sold helps determine the periodic income and financial position. The periodic method does not record the cost of the inventory sold for a particular sale. Record your total discount in your journal by combining the inventory sales and the sales discount entries.

Some companies put it under the inventory sub-account, however, we can put it in any account as it is just a temporary account. After Corner Bookstore makes its third purchase of the year 2023, the average cost per unit will change to $88.125 ([$262.50 + $90] ÷ 4). As you can see, the average cost moved from $87.50 to $88.125—this is why the perpetual average method is sometimes referred to as the moving average method. The Inventory balance is $352.50 (4 books with an average cost of $88.125 each). With perpetual LIFO, the last costs available at the time of the sale are the first to be removed from the Inventory account and debited to the Cost of Goods Sold account.

Cost Flow Assumption Diagram

Therefore, before any adjusting entries, the balance in the merchandise inventory account will reflect the amount of inventory at the beginning of the year, as indicated in the following T-accounts. A periodic inventory system does not keep continuous track of ending inventories and the cost of goods sold. Instead, these items are determined at the end of each quarter, year, or accounting period. You can use them to get paper inventory lists, import the stock data and calculate the data you need to order more stock and reconcile the stock you have for a new period. A company will choose the software based on its needs and the requirements of its products.

More specifically, under a periodic inventory, the physical count of inventory and calculation of the inventory costs is done periodically, at regularly occurring intervals. A periodic inventory system is an approach businesses can use to evaluate their merchandise inventory and the cost of goods sold. So, instead of keeping track of the decrease or increase in merchandise every time a financial transaction occurs, businesses using periodic inventory do it at different time intervals. Consequently, there are no merchandise inventory account entries during the period.

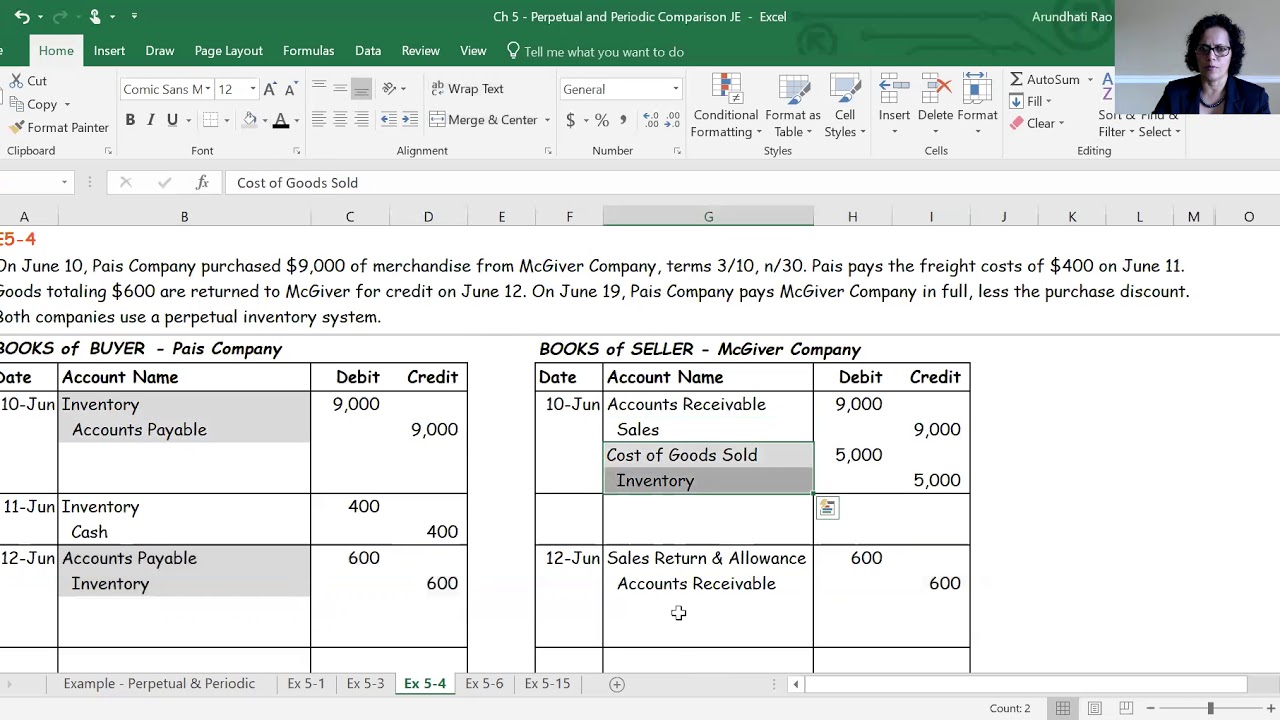

Generally Accepted Accounting Principle allows firms to accept any model. XThe periodic system can be used in small and retail businesses where the inventory quantity is generally high, but the value is on the lower side. The counting and tracking may be done either monthly, quarterly or annually filing a joint tax return when married and living apart and helps in keeping a steady and continuous record of the quantity of inventory with the company. The example below shows the journal entries necessary to record inventories under the periodic system. The information from the example data illustrates the perpetual inventory method.

Periodic and perpetual inventory systems are different accounting methods for tracking inventory, although they can work in concert. Overall, the perpetual inventory system is superior because it tracks all data and transactions. However, with a perpetual system, you need to make more decisions to use it successfully. A perpetual system is more sophisticated and detailed than a periodic system because it maintains a constant record of the inventory and updates this record instantaneously from the point of sale (POS). However, perpetual systems require your staff to perform regular recordkeeping. For example, in a periodic system, when you receive a new pallet of goods, you may not count them and enter them into stock until the next physical count.